This month’s update will run longer than normal, as I would like to share three stories that I believe help illustrate how hybrid investment strategies (a blend of passive and active management) can prove especially beneficial to investors during periods like the past two years. These stories include clients making a new investment into the financial markets, clients over age 72 needing to take annual required minimum distribution (RMD) from IRA accounts, and all other BLI clients.

For perspective, here is the performance for the S&P 500 Index according to www.slickcharts.com, along with the BLUE LINE INVESTING® (BLI) Stock Strategy, the primary strategy used by most of my clients. All figures are net of fees and have been rounded.

By the time you finish reading this update you will have a better understanding of why I believe limiting losses during the negative years is the single best strategy to both grow and preserve your wealth.

STORY #1:

A client contacted me near the end of calendar year 2021 with $400,000 of new money to invest. They deposited this amount to their brokerage account on December 21, 2021.

In my book, Protecting the Pig: How Stock Market Trends Reveal the Way to Grow and Preserve your Wealth, I explain in Chapter 10 titled, Timing is Everything, several ways to invest money depending on the prevailing trend of the financial markets. For the couple months leading up to the end of 2021, I had been documenting on this blog that something seemed wrong with the financial markets. As a result of what I was observing, I elected to apply the “Deferred Purchase” option found on page 102 to invest this couple’s money. In other words, as the stock market experienced a temporary top and thereafter declined, this couple’s money remained in cash with the only “loss” being my advisory fee that they paid to follow my process. This helped preserve their wealth.

Eventually, their money was fully invested later in the year at lower prices, and by the end of 2023, their account value was $443,152. In other words, by deferring the purchase of their money in financial markets (also known as timing the market), this couple avoided any initial losses and instead benefitted from gains. Over this two-year period, their account annualized 5.25% net of fees compared to 1.65% for the S&P. Had they invested their money passively at the end of 2021, they could have watched their money drop from $400,000 to $328,000 the first year, before recovering to $413,000 by the end of 2023. The lesson to learn is just because someone has money available to invest on a given day doesn’t necessarily mean they should invest it. Patience can be a virtue.

STORY #2:

The second couple are both over age 72 ½ and are taking required minimum distributions (RMDs) from their IRA accounts each year. This means every year they must take a specified minimum dollar amount from their IRA so the government can collect taxes. What makes this story interesting is that during 2022, it wasn’t only the stock markets that lost–the bond markets lost as well.

Even though this couple is in their 70’s, have 70% of their accounts allocated to the stock market and only 30% to the bond market, they experienced minimal loss during 2022. In other words, when they needed to remove money from their IRA accounts, they didn’t experience any panic or emotional “worry” since their wealth had been protected and their losses limited (compared to other similarly invested accounts of their friends). Fast forward to 2023 and their resulting gains (9% net of fees) replaced their losses from 2022. This afforded them the opportunity to continue growing their wealth in their “golden years” to continue funding an active and enjoyable lifestyle.

STORY #3:

The third and final story applies to just about every BLI client. Even though my stock strategy underperformed during 2023, just about every client has more money in their accounts–net of fees–than they would have had they passively invested in the S&P. Consider the following comparison based on the performance numbers provided at the beginning of this article. If you had invested $100,000 in the S&P at the beginning of 2022 you could have watched your money drop in value to $82,000 by the end of the year, before recovering and rising to $103,320 by the end of 2023. Alternatively, for those who invested the same amount in my stock strategy, they would still have $95,000 by the end of 2022 and $106,400 by the end of 2023.

What I am striving to express using these three examples is the importance of protecting against the downside when investing, and how all investors, even those at different points in their lives, can benefit. Limiting losses can help long-term outperformance, as well as limiting emotional reactions that can result from big swings in investment account values.

Of course, I must say that there are no guarantees that the results of 2022 will be repeated in the future. But the question I hope every investor asks themselves is, “What are the odds that people who didn’t see the risks building in 2022 will see the risks building before the next major decline?”

STOCK MARKET, THE TREND:

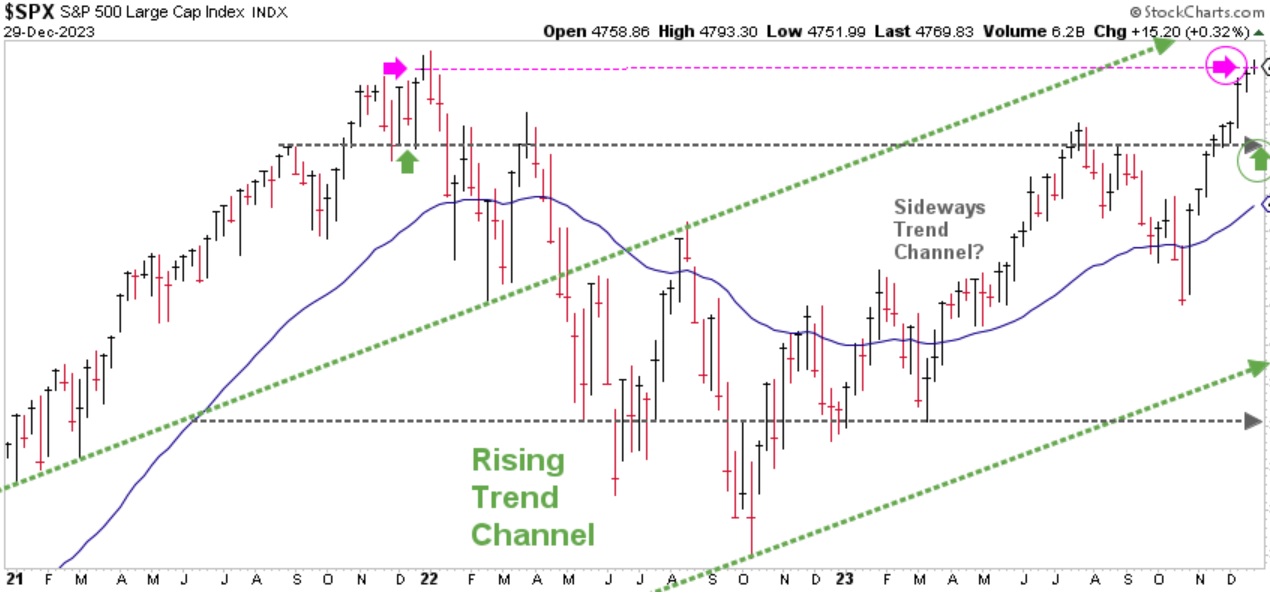

Chart courtesy of StockCharts.com

So far, the long-term, rising trend continues. The S&P continued rallying during December and, to my surprise, rose from the top, gray-dashed line to the pink-dashed line. Since the gray line has been a price zone of resistance and support over the past couple years, I would not be surprised if the market eventually retraces back to that level to “test” it sometime in the weeks or months ahead.

STOCK MARKET, WATCHING FOR THE SUMMIT:

Chart courtesy of StockCharts.com

The S&P finished the month of December 9.06% above the Blue Line, compared to being 6.16% above the Blue Line at the end of November.

I can never say thank you enough to all of you who are clients for allowing me to be a part of your life and for your continued trust, confidence, support, and referrals. As I said earlier last year, I believe this process will help all investors over the years ahead, regardless of what the financial markets throw at us.

Jeff Link

Disclaimers:

The BLUE LINE INVESTING® (BLI) investment process was founded on over 95 years of stock market history. It seeks to identify and align investment decisions with multiyear trends. Various aspects of this process have been illustrated in my book Protecting The Pig: How Stock Market Trends Reveal the Way to Grow and Preserve Your Wealth.

The S&P 500 Index is one of the most commonly followed equity indices, and many consider it one of the best representations of the U.S. stock market, and a bellwether for the U.S. economy. It is comprised of 500 large companies having common stock listed on the NYSE or NASDAQ. The volatility (beta) of the account may be greater or less than the index. It is not possible to invest directly in this index.

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volumes. Technical analysis attempts to predict a future stock price or direction based on market trends. The assumption is that the market follows discernible patterns and if these patterns can be identified then a prediction can be made. The risk is that markets may not always follow patterns. There are certain limitations to technical analysis research, such as the calculation results being impacted by changes in security price during periods of market volatility. Technical analysis is one of many indicators that may be used to analyze market data for investing purposes and should not be considered a guaranteed prediction of market activity. The opinions expressed are those of BLI. The opinions referenced are as of the date of publication and are subject to change without notice. BLI reserves the right to modify its current investment strategies based on changing market dynamics or client needs.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Guardian Wealth Advisors, LLC (“GWA”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about GWA’s investment advisory services can be found in its Form CRS or Form ADV Part 2, which is available upon request.

GWA-24-04