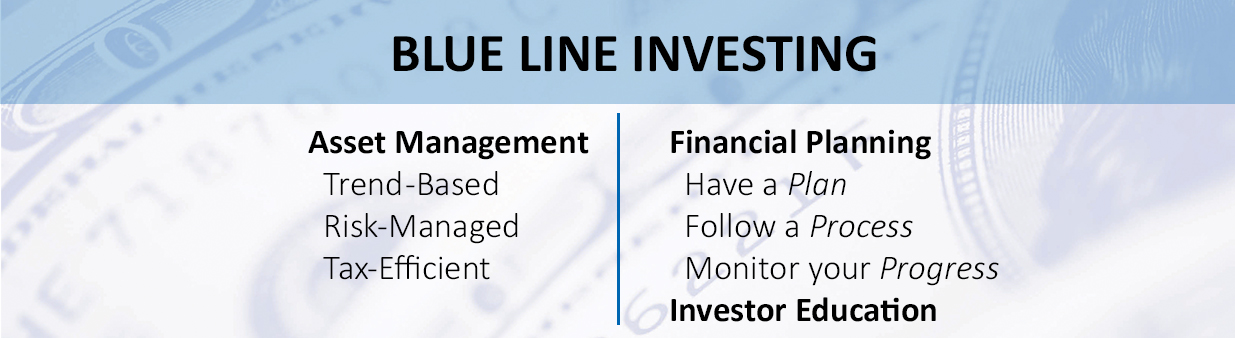

HELPING INDIVIDUALS AND FAMILIES NAVIGATE THE UPS AND DOWNS OF THE FINANCIAL MARKETS TO FIND FINANCIAL FREEDOM

What is financial freedom to you? Is it the freedom to retire early without fear of outliving your money? Is it the freedom to enjoy a work-optional lifestyle? Is it the freedom from worry of losing your lifetime wealth? The freedom from making emotional investment decisions? What could your life be like if you followed a process that could help you find your financial freedom?