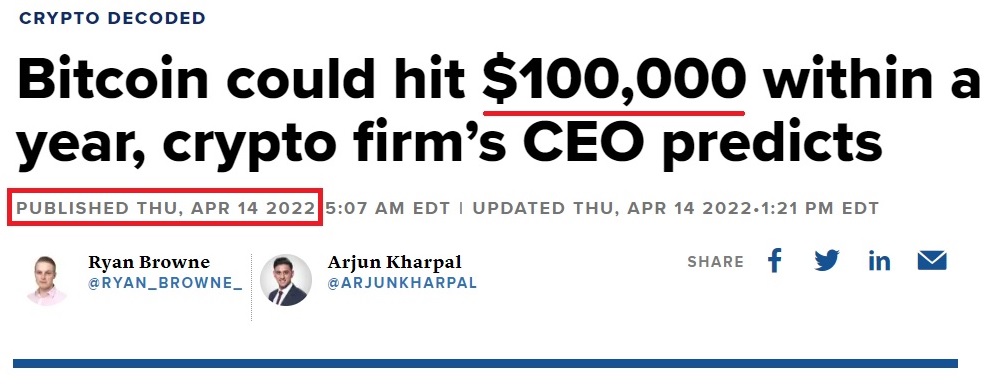

Do you remember reading articles like the one below¹ earlier in the year?

You will notice it was published on April 14th, 2022. On that day, Bitcoin was trading for approximately $40,000 per coin (down from the all-time high of $66,000 in November 2021).

Fast forward to today and here’s a recent headline²:

What happened? It’s the same old story of every bubble throughout history – once everyone who believes has bought, there’s no one left to buy! And without buyers, price begins to fall under its own weight.

I will share the stories of “Bradley” and “Peter” who invested in Bitcoin and how their application or nonapplication of investment rules impacted their investment outcomes.

“Bradley”

Bradley made a fantastic investment speculation a few years ago. He purchased $1,000 worth of Bitcoin and watched it become $8,000. As he read all the stories, headlines, and Bitcoin chat forums, he was convinced it was the future! So, he purchased another $8,000 at higher prices.

One of the biggest challenges that comes from investment success is it can breed greed. As Bitcoin continued rising, he continued buying. But eventually, it topped. The last buyer had bought – but Bradley didn’t realize it. So, as it began falling, he continued buying.

He claimed, “It’s a buying opportunity” when the price first dropped to around $53,000 so he bought more. He made the same comment when it dropped to the low $40,000’s. He said the same thing when it reached $30,000. Now it’s below $18,000, and there’s still no bottom in sight (at least not yet).

“Peter”

Now consider Peter. Around the same time Bradley was buying more in the low $40,000’s, Peter was telling people he had over $100,000 invested in Bitcoin. All his friends’ comments supported his beliefs. But after he talked with an investment professional, he learned the technical indicators suggested lower future prices. Unlike Bradley, he didn’t keep his investment hoping to “buy the dip.” Instead, he did something drastic – he sold 90% of his Bitcoin holdings.

Today, many Bitcoin investors likely wish they would have done what Peter did. So, I offer the following three rules that I believe every investor should follow with all investment decisions to keep from becoming a Bradley:

First, IGNORE THE HEADLINES. Seek out sources that challenge your beliefs to see if there is something you haven’t factored into the picture. Bradley did the opposite – choosing instead to listen to sources that supported his beliefs. This was his first mistake.

Second, ask yourself “What if I’m wrong?” After the trend in Bitcoin turned negative, Bradley continued buying at lower prices as if they were buying opportunities. But they weren’t. Those purchases became additional losses. This was his second mistake.

Third, have an exit strategy. Bradley never thought about selling his investment because he considered himself a “long-term” investor. But there are no rules that say a long-term investor should remain fully invested. Had he sold it, there is nothing preventing him from buying it back later. This was his third mistake.

It’s very sad that so many people have lost so much money in the cryptocurrency collapse, and as far as I can tell it doesn’t appear to be over yet. But bubbles are nothing new. In a previous article I referenced an old friend who did the same thing as Bradley in 1999 with CISCO stock. He bought in near the top and held it all the way to the bottom. I also remember him saying something similar – “That’s okay, I’m a long-term investor.” Over the next couple of years, he ended up selling his shares in the low twenties after purchasing them in the low sixties. So much for being a “long-term” investor.

If you are not one of our existing clients and would like to learn how our investment process may help you navigate the stock market roller coaster using trends to help grow your wealth when trends are rising and preserve it when they are declining, please call (833) 258-2583.

Jeff Link

Disclaimers:

¹ https://www.cnbc.com/2022/04/14/bitcoin-btc-price-could-hit-100000-within-a-year-crypto-ceo.html

The BLUE LINE INVESTING® (BLI) investment process was founded on over 95 years of stock market history. It seeks to identify and align investment decisions with multiyear trends. Various aspects of this process have been illustrated in my book Protecting The Pig: How Stock Market Trends Reveal the Way to Grow and Preserve Your Wealth.

The S&P 500 Index is one of the most commonly followed equity indices, and many consider it one of the best representations of the U.S. stock market, and a bellwether for the U.S. economy. It is comprised of 500 large companies having common stock listed on the NYSE or NASDAQ. The volatility (beta) of the account may be greater or less than the index. It is not possible to invest directly in this index.

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volumes. Technical analysis attempts to predict a future stock price or direction based on market trends. The assumption is that the market follows discernible patterns and if these patterns can be identified then a prediction can be made. The risk is that markets may not always follow patterns. There are certain limitations to technical analysis research, such as the calculation results being impacted by changes in security price during periods of market volatility. Technical analysis is one of many indicators that may be used to analyze market data for investing purposes and should not be considered a guaranteed prediction of market activity. The opinions expressed are those of BLI. The opinions referenced are as of the date of publication and are subject to change without notice. BLI reserves the right to modify its current investment strategies based on changing market dynamics or client needs.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Guardian Wealth Advisors, LLC (“GWA”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about GWA’s investment advisory services can be found in its Form CRS or Form ADV Part 2, which is available upon request.

GWA-22-112