A client recently asked what I would advise she do if she decided to retire this year. She is 74 and her question centered around her investment strategy and whether it should change based on her age (and retirement). My response was simple and straightforward: no. The biggest mistake I believe investors make is when they make changes to their investment strategy based on their age. This is a backwards concept and is like putting the cart before the horse. As I explained in my book, Protecting The Pig, I believe a better course of action is to make investment strategy decisions based on the prevailing trend of the market.

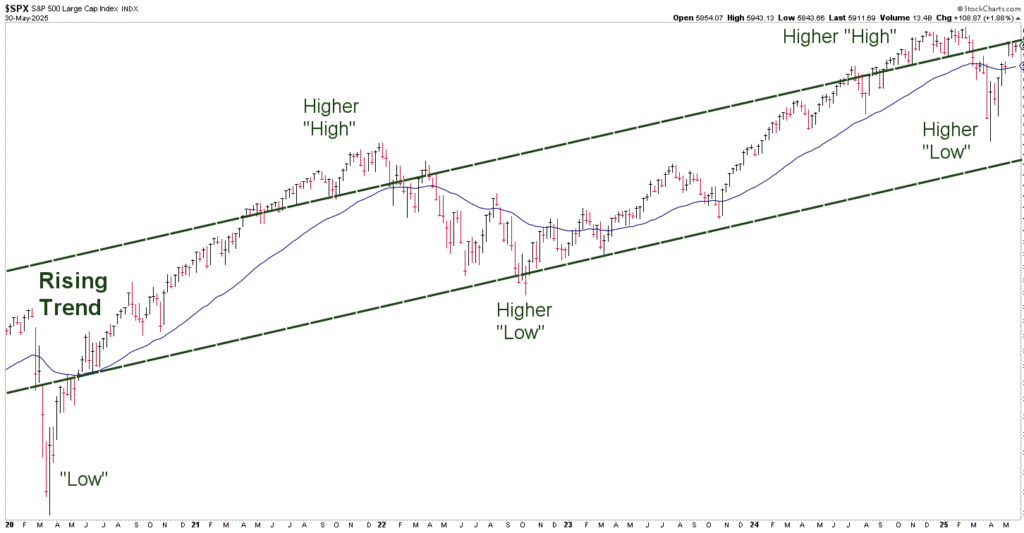

To clarify, look at the chart below. I have been providing monthly updates on this chart for quite some time and the chart below represents almost 5½ years. For new readers, the parallel, rising green lines represent the rising trend channel for the S&P 500 Index, which happens to be the primary investment owned within the BLUE LINE INVESTING investment strategies. During the past 5½ years there have been times when the price of the S&P has gone up and down. But when we look at it from this perspective, we notice that each successive “high” is higher than the previous high. And each successive “low” is higher than the previous low.

STOCK MARKET, THE TREND:

Chart courtesy of StockCharts.com, Data as of 5/31/25

If this pattern continues to unfold into the future, higher highs and higher lows should be expected. The main point I wanted my client to understand is that her age has nothing to do with the prevailing trend of the financial markets. While the trend is rising, I believe she should strive to take advantage of it for as long as she can. There are a few potential benefits that this could provide her.

- She could accumulate more wealth that could result in her being able to draw larger “paychecks” for herself from her investments during her retirement years.

- She could extend her wealth by replacing withdrawals from her IRA account due to Required Minimum Distributions (RMD’s) with additional appreciation from the underlying investment(s).

- She could eventually pass on more wealth through inheritance to beneficiaries upon her passing, including worthwhile charities.

The mistake I routinely see is when people make investment decisions based on their age rather than the prevailing trend. When they do, they typically become too conservative with their investments which can lead to future financial shortages and a reduction of life opportunities and activities.

With all this said, someone may say the risk of investment loss at her age outweighs the potential benefits of additional gains. To this I would agree, IF I wasn’t paying attention to the market, its behavior, and changes in the underlying trend. There is an old saying, “Make hay while the sun shines.” As I have written and illustrated in my book, the MAJOR top of this rising stock market will eventually be confirmed when the price of the S&P falls below and remains below the Blue Line. Until then, I believe investors should continue to make hay.

STOCK MARKET, WATCHING FOR THE SUMMIT:

Chart courtesy of StockCharts.com, Data as of 5/31/25

The S&P finished the month of May 4.2% above the Blue Line, compared to being 1.4% below the Blue Line at the end of April. If you return to the first chart, you will notice the rally has reached the top rising, green-dashed line to test it (refer to the upper right-hand corner of the chart). If the S&P fails to break through, price consolidation or decline could unfold thereafter.

Jeff Link

Disclaimers:

The BLUE LINE INVESTING® (BLI) investment process was founded on over 95 years of stock market history. It seeks to identify and align investment decisions with multiyear trends. Various aspects of this process have been illustrated in my book Protecting The Pig: How Stock Market Trends Reveal the Way to Grow and Preserve Your Wealth.

The S&P 500 Index is one of the most commonly followed equity indices, and many consider it one of the best representations of the U.S. stock market, and a bellwether for the U.S. economy. It is comprised of 500 large companies having common stock listed on the NYSE or NASDAQ. The volatility (beta) of the account may be greater or less than the index. It is not possible to invest directly in this index.

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volumes. Technical analysis attempts to predict a future stock price or direction based on market trends. The assumption is that the market follows discernible patterns and if these patterns can be identified then a prediction can be made. The risk is that markets may not always follow patterns. There are certain limitations to technical analysis research, such as the calculation results being impacted by changes in security price during periods of market volatility. Technical analysis is one of many indicators that may be used to analyze market data for investing purposes and should not be considered a guaranteed prediction of market activity. The opinions expressed are those of BLI. The opinions referenced are as of the date of publication and are subject to change without notice. BLI reserves the right to modify its current investment strategies based on changing market dynamics or client needs.

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Guardian Wealth Advisors, LLC (“GWA”) is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about GWA’s investment advisory services can be found in its Form CRS or Form ADV Part 2, which is available upon request.

GWA-25-55