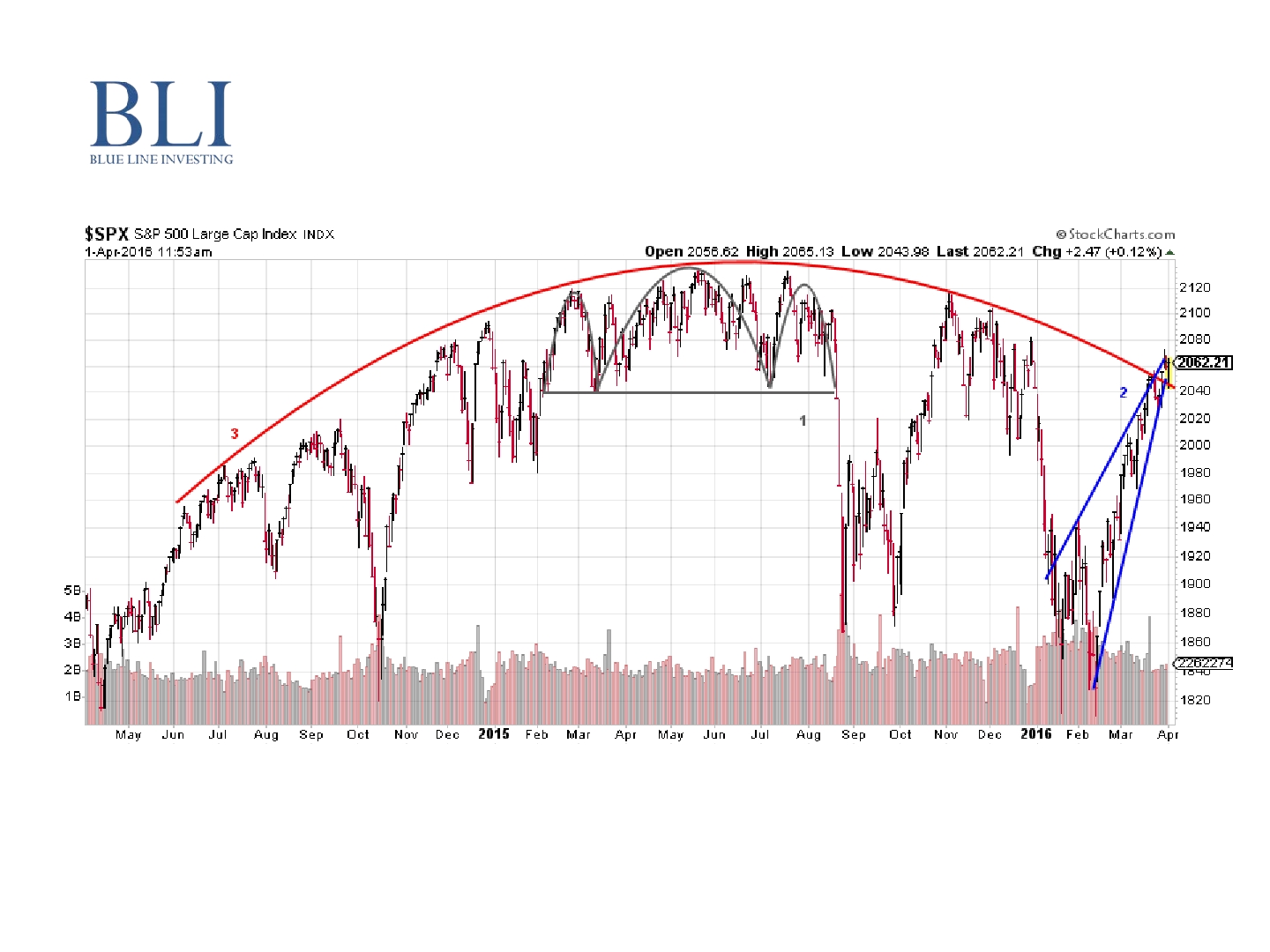

Stock markets may not be as random as many investors think. Believe it or not, the market has its own way of “speaking.” Sometimes its speech can be elegant, and other times crude, but nevertheless, it does speak. The stock market has spoken in the past and may be speaking at present. For illustration I have provided the chart above showing the price fluctuations of the S&P 500 Index – one of the most commonly followed equity indices, and considered by many to be one of the best representations of the U.S. stock market. What might the stock market be saying?

Using gray lines on the chart above I have illustrated a Head-and-Shoulders technical formation (#1). This negative pattern warned of a possible selloff in the short-term, which ultimately came to pass. I have also illustrated a potential Ascending Wedge technical formation using blue lines (#2). This is another potentially negative pattern that warns of a possible price correction in the short-term. Time will tell if it comes to pass. Finally, I have illustrated a much broader technical formation called a “Rounded Top” using a red line (#3). Like the previous two formations, this also is a potentially negative formation, and if it comes to pass, may result in additional price corrections in the weeks and months to come. Do any of these formations guarantee a specific outcome? Unfortunately, no. So what are they good for?

First, if an investor is going to make a new investment in the stock market, these patterns may help them evaluate whether doing so at that moment in time could prove beneficial or detrimental in the short-term. After all, even if they consider themselves a “long-term” investor, wouldn’t they rather buy prices “on sale?”

Second, if an investor already has some or all of their money invested in the stock market, knowing these patterns may allow them choice. If they are a profit seeking investor, they have choice of implementing strategies that could help protect their portfolio against possible loss. Alternatively, they have choice of ignoring the potential warnings and hope for the best. Either way, investors always have choice.

I believe as investors become more knowledgeable of the market’s “language” they will begin to implement proactive investment decisions for their portfolios rather than taking a “wait and see” approach.

Disclosures:

Advisory services offered through Gordon Asset Management, LLC (GAM). GAM is an SEC-registered investment adviser. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained at no charge, by calling (866) 216-1920. Registration does not imply a certain level of skill or training. The principal office of Gordon Asset Management, LLC is located at 1007 Slater Road, Suite 200, Durham, North Carolina, 27703. Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be construed a recommendation to purchase or sell any particular security. This information is intended for educational purposes only.